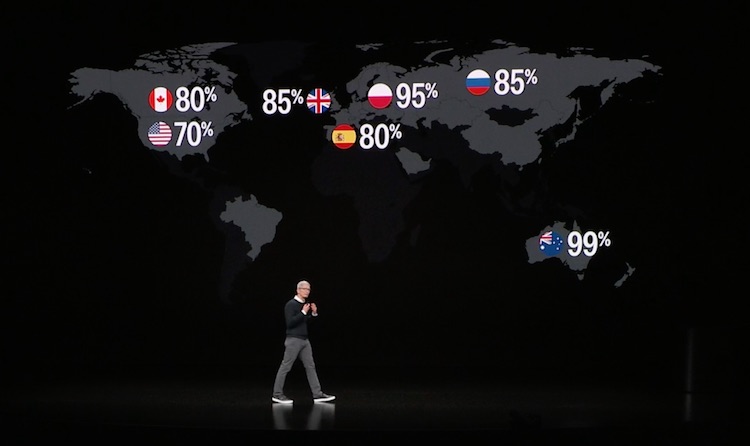

Apple celebrated its payment systems and introduced new payment services at its Monday keynote at the Steve Jobs theater in Cupertino, California. The company shared that Apple Pay has been a wild success since its 2014 inception, with over 10 billion transactions globally and a 70 percent acceptance rate in the U.S.

Several other countries have even higher rates, such as Australia, where 99 percent of retailers accept Apple Pay. The service rollout continues through 2019, with over 40 countries slated to begin using Apple Pay by the end of the year.

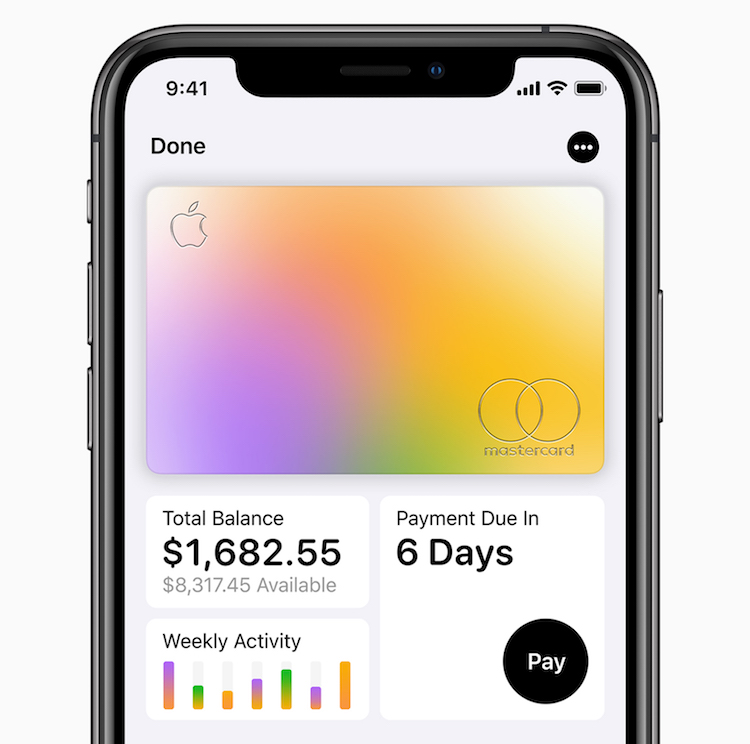

The highlight of Apple’s payment services announcement was the unveiling of Apple Card — a digital credit card that works worldwide, anywhere Apple Pay is accepted. Users can sign up for the card right away and use it across all devices. The Apple card is available through the iPhone Wallet App for set up and easy access. With an aim to help users develop a healthier financial life, the Apple Card has no annual fees, international fees, or exceeding limit fees. Apple also allows users to schedule more frequent payments if they desire. The card has a mobile interface that allows users to easily access their total balance, purchase and payment history, due dates, and other information. The Apple Card also offers customer service through iMessage, for easy access to help.

A notable feature on the Apple Card is its Daily Cash, which is Apple’s version of bonus points that users can accrue with use of a typical credit card. Instead of having to wait until the end of a billing cycle, Apple’s Daily Cash updates as soon as purchases are made and are available for use immediately. Users can collect unlimited Daily Cash and use it just like real cash, for regular purchases, paying off

For those who still like the feel of an actual card, Apple is offering a physical Apple Card made of Titanium and designed in a typical Apple fashion. The card features no card number, CVV security code, expiration date, or signature on its surface, but will have the customary Apple logo and the user’s name engraved. Users can access all of the above-mentioned information within Apple Wallet, and all the necessary information for active purchases is stored on the card’s EMV chip. The physical Apple Card offers 1 percent daily cash for purchases.

Apple also discussed how its Apple Pay has been optimized in cities, such as London, Moscow, Tokyo, Beijing, Shanghai, and Guangzhou, where the mobile payment system is available for transit access.

With Apple Pay technology, users can scan mobile transit cards as turnstiles to enter trains and busses. The transit payment system will begin rollout in the U.S. starting this summer in cities including Portland, Chicago, and New York City. Once available, users will be able to find the transit update in the Wallet App of their iPhones.

© 2024 TechViewPRO